Bombay (Mumbai), Dec 28 (PTI) First, it was outspoken Raghuram Rajan and then old Rs 500/1,000 notes, including those bearing his signature — 2016 saw them exit the Mint Street riding such big waves of controversies that their ripple effect is bound to be felt in the new year.

Rajan was replaced by a low-profile Urjit Patel as the new Reserve Bank Governor and the good-old Rs 500 banknotes made way for a new grey-colour replacement while a brand new pink Rs 2,000 note also entered the scene. A replacement for old Rs 1,000 notes is still awaited.

In his three-year tenure at RBI that ended this September, Rajan stoked several controversies with his comments on almost all issues under the sun — including on political, social, academic and obviously economic issues.

In contrast, his successor Patel has often been criticised in some quarters for keeping mostly silent — a trait which was initially seen as having gone in his favour after Rajan’s vocal nature.

In his first-ever interview, Patel was however forceful in his own way when he told PTI that the demonetisation was “once in a lifetime event” and he was taking all necessary steps to “ease the genuine pain of citizens who are honest and who have been hurt”.

From steering the monetary policy deliberations amid frantic calls for rate cuts to mounting the necessary mechanism for a daily monitoring of demonetisation move to keeping printing presses up and running to print replacement notes for scrapped ones — it has been a bit too hectic for Patel since he took charge on September 4.

While Rajan is known to have opposed the idea of demonetisation, especially to fight black money, Patel urged the people to start using cash substitutes like debit cards and digital wallets, saying it will make transactions cheaper and easier and in the long term will help India “leapfrog into a less cash-use economy at par with more developed nations”.

But the joke, doing the rounds on social media and through WhatsApp, is that it is mostly the ATMs that have gone cashless and standing in queues to withdraw money is the new normal.

If not for the note ban, the leadership change would have been the most dominant factor of 2016 for the Reserve Bank, but its ‘advice’ to the government to scrap high-value currency notes will keep it busy for a long time to come, and success of the move will determine its credibility as well.

The final word is still to be said on the exact amount of the value carried by the scrapped notes and the estimates so far vary from about Rs 14.4 lakh crore to over Rs 20 lakh crore, even as the so-called ’50-day’ period of ‘pain’ and transition will end this week.

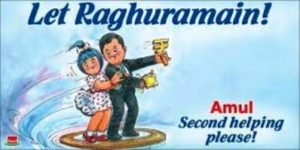

The famous Amul cartoons have poked fun at RBI by calling it ‘Reverse Bank of India’, referring to the issuance and re- issuance of more than 60 circulars already since the demonetisation announcement on November 8.

By Ashish Agashe and Hitesh Vyas